Technical analysis of Bitcoin for 02.05.2019

Crypto Industry News:

CoinMarketCap will remove the exchanges from its calculations if they do not provide mandatory data by June, the company wrote in its blog entry on the occasion of the sixth anniversary.

CoinMarketCap, the main source of data on all digital currencies sold, has published a series of announcements on the occasion of its sixth birthday. Consequently, CMC announced a new alliance called Data Accountability & Transparency Alliance (DATA) to ensure “greater transparency, accountability and disclosure of project information in the cryptographic space”.

A huge number of exchanges have joined the new alliance, including Binance, Bittrex, OKEx, Huobi, Liquid, UpBit, IDEX, OceanEX, Gate.io, KuCoin, HitBTC and Bitfinex, with more partners expected in the future.

As part of its transparency initiative, CoinMarketCap will now require all cryptographic exchanges to provide mandatory API data that includes transaction data and order portfolio data in real time. Emphasizing that the condition will be mandatory, CMC has written that no stock exchange that does not provide these mandatory data will be included in the price calculation and the adjusted volume on the page.

The stock markets now have a 45-day grace period to send the required data, while the changes will take effect on June 14, 2019, CoinMarketCap writes.

Technical Market Overview:

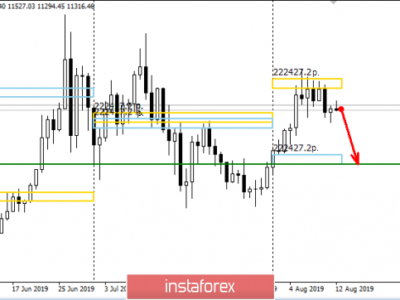

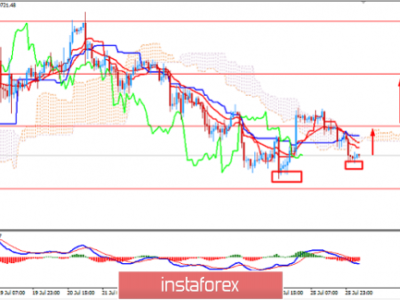

The BTC/USD pair has broken above the technical resistance at the level of $5,666 and made a local higher high at the level of $5,710 at the time of the writing the article. According to the scenario, this is still a part of the corrective wave (b) in the making, so after the target at the level of $5,728 is hit, the market should reverse. Moreover, the move up has been made in three waves only, so any violation of the level of $5,528 will confirm the corrective wave (b) scenario.

Weekly Pivots:

WR3 – $6,630

WR2 – $5,993

WR1 – $5,751

Weekly Pivot: $5,379

WS1 – $5,117

WS2 – $4,744

WS3 – $4,481

Trading recommendations:

The level of the recent high at $5,666 is a good level to enter a short term sell position with a target at the level of $5,348 or even below ( it all depends on the form of the corrective cycle in wave (c)). The longer-term outlook is still bullish, but currently, the market entered a corrective cycle.

The material has been provided by InstaForex Company – www.instaforex.com